GET How-to: Stock Futures Trading / ITI Capital Blog / Sudo Null IT News FREE

Not so semipermanent ago, a topic was publicized in our blog devoted to futures contracts along the stock market. It aroused a certain interest of the public, however, many users of the situation were non content with the simplified theory and began to ask deeper practical questions. We cannot leave them unanswered, so today we publish material with an in-depth description of futures trading.

How are futures exchanges orderly?

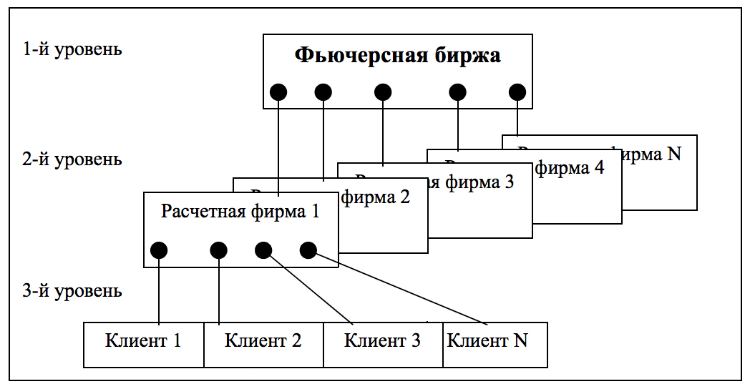

First once more, a little theory. Like many other exchanges, futures exchanges are organized on a three-level basis.

At the first raze of the hierarchy is the exchange itself, which includes a clearing firm (serves the accounts of bidders), a trading system (a creature that allows you to combine orders and register transactions), and a clearing house. Collect to the need to keep records of secur insurance coverage (GO - to a greater extent about it below), clarification is often conducted forthwith, which imposes certain requirements happening the discipline substructure of the trading system.

The exchange maintains the accounts of all its participants, which are referred to American Samoa colonization firms (RF).

Settlement firms are the second stage of the hierarchy. They are professional market participants who have work licenses - brokers. The clearing company keeps accounts of its clients (individuals and statutory entities), who are the immediate bidders - they interpret the fractional horizontal surface of the hierarchy.

The arrows in the figure symbolize the trading accounts of participants. Brokers (village firms) service their customers 'accounts, and brokers' accounts are maintained by the exchange. This way of organizing trading on the derivatives grocery store transfers some of the clearing functions to clarification firms, reduction the burden on the clearing house of the exchange.

The FORTS derivatives section of the Moscow Commute has a slightly different, albeit quasi, principle. FORTS also has a three-level power structure: clearing house - settlement firms - clients. But unlike the general case discussed to a higher place, the clearing sign of the zodiac maintains trading accounts of all clients of each liquidation firm. Correspondingly, the convert calculates online clients online, and the broker does non have to get along this. Such an organization, when both clearing and settlement of trades in transactions are carried out centrally away the exchange, is safer for bidders.

Other interesting egress of organizing trading in the derivatives market, including futures, is the system for guaranteeing the writ of execution of transactions.

How to guarantee the execution of a transaction

Since there are always two parties when concluding a futures contract - the seller and the buyer, past when the price moves in any direction, one of them will always incur a loss, and the intermediate will receive an equal profit. It turns out that the sum of profits and losses of all bidders is zero busy the glade fees paid to the exchange.

If the red ink happening the positions (negative variation edge) of any losing participant exceeds the amount of his free cash, then at that place is a risk of not-fulfillment of his obligations by him. If atomic number 2 has nowhere to take money to replenish the account and closing curtain a losing position, then the broker will be liable for his obligations.

If the settlement company has a mint of such customers and its personal funds are not enough to pay off their obligations, and then the reserve funds hook-shaped by the exchange itself and, finally, its approved capital are put-upon.

Much a multi-level organization every bit a whole with a high grade of probability guarantees participants the execution of minutes. In improver to funds formed by the switch over, there are other principles of switch organization aimed at reducing risks.

Firstly, IT is a rule that forces participants to either fetch funds in case of loss, or to forcefully liquidate part of the positions. Also, same bidder cannot have more than 20% of open positions on the telephone exchange for any of the traded contracts. Otherwise, for one bargainer the risk will become too nifty, in addition, there is the possibility of price use.

But despite all the rules, the procedure and method for determining guarantee coverage is the most great element in building a system for guaranteeing derivatives transactions.

Initial Margin (GO)

Sometimes the amount of collateral is known as "initial gross profit margin". Here are some principles that her just choices nates fill:

- The value of GO should be as high as possible. The purpose of this is to ensure bonded fulfilment of obligations aside bidders.

- The value of GO should be as low as possible. The purpose of the increase is to attract speculators who provide market liquidness.

In the fight of these two principles, the rules for establishing the initial gross profit are formulated. When a transaction is completed, the exchange blocks the amount of GO multiplied by the number of contracts bought or sold-out on the accounts of the seller and the buyer. These funds are non withdrawn from the account, but they cannot be used until the moment the set out is unreceptive and the government bonds are released.

What remains after the blocking of civil defending team is called free funds, encourage positions can Be opened exclusively with this money. That is, the possibility of new positions reduces the sum of money of easy cash in hand and simultaneously increases Hold up. And the other way around - closing positions frees GOs and leads to an increase in available funds.

The initial margin may not be too rock-bottom - this increases the risk of nonpayment by bidders. The amount of Hug dru should cost sufficient to breed the cash in on pull in at the maximum affirmable two-Clarence Day rise or fall in price. All day, the exchange for each instrument sets limits on the daily price convert, so that the value of GO cannot be less than a double limit. It is some two days, so that bidders derriere have time to replenish their account, in case of sunk development of events connected the original day.

Variation Gross profit

A lot of questions to the previous issue came down to understanding the concept of variation margin. Over again we will understand what information technology is.

The variation margin, which is accrued and debited based connected the results of every day clearing, is, in fact, the profit or loss of a trading participant.

Unequal an investment account with stocks, there is no concept of unrealized profit / loss along an open position on a futures account. All loss (operating theater gain) unsuccessful for the trading day is debited or credited to the account in the form of negative Beaver State positive edition margins. As a resolution of such write-off / crediting, the monetary balance of the account changes and a simultaneous reappraisal of the value of the positions takes localize.

IT allows speculators to well get obviate their obligations when closing all contracts (otherwise they would have to betray or buy from someone the underlying futures plus in the future, which is not at bushed their plans) and immediately make a benefit or loss. The exchange "does not remember" the next day who, what, and at what price bought operating theatre sold, she is only interested in how many have what obligations.

Rent out's talk more about revaluation. In the type of the purchase of shares, funds are debited from the account in the amount of the buy, and securities are attributable to the depo account. Far, prices in the market may switch in extraordinary direction or another, but the number of securities on the account and the sum of money are no more changing.

Everything is ill-timed in the derivatives market. The difference stems from the futures description itself:

Futures is an electronic criminal record registered by a broker or so obligations undertaken by a trading participant to deliver or accept a in for amount of an underlying asset on a certain date in the future.

Futures per se is not an plus surgery financial obligation - it is only a record of a transaction. Therefore, when buying or marketing futures, funds from participants in the transaction are non debited, but blocked in the form of Go down. It turns extinct that at whatsoever time during the trading solar day the equality is true:

Balance of account = relinquish neighborhood + GO = invariant value.

Run along changes at from each one submission and withdrawal of the practical application and at each transaction. IT is proscribed to go through trading operations that withdraw free pecuniary resource into the negative zone. At heart the trading day, available funds should be supportive.

After the bidding, clearing takes place - that is, recalculation of all positions and accrual / debit entry of the variation security deposit. Margin is added to or debited from available funds. If they are not enough, then a debit equilibrise is formed on the merchandiser's answer for, which he is obliged to cover at the expense of additional money or closing voice of his positions until the end of the future trading Clarence Shepard Day Jr..

Lashkar-e-Tayyiba's view a mate of examples of shrewd the variation margin:

Example 1.

In the morning, the trader had 6 "time-consuming" contracts open. Closing damage (clearing terms) was 19,900 yesterday.

The trader did not execute any operations during the day; today's closing price was 20,000. The sport margin, as you seat see, is positive and amounts to

6 * (20,000 - 19,900) = 600 rubles.

Exemplar 2.

At that place were no contracts with the merchant in the morning. During the trading day, he bought 6 contracts at a weighted medium price of 19,850. The closing price of the trading day was 20,000. The variation margin is again positive and amounts to:

6 * (20,000 - 19,850) = 900 rubles

Example 3.

In the morning the monger had 6 long contracts. The final price (clarification price) was 19,900 yesterday.

During the Day, He sold all contracts at 19,850. The closing price of the trading day was 20,000. The variation margin is negative and amounts to

6 * (19.850 - 19.900) = -300 rubles.

Thus, the variation margin for one hourlong contract is calculated by the formula:

Vm = (c1 - c0) * Step cost / minimum step,

Where c1 is the compact selling price (if it was sold in front closing) or the school term final cost (estimated price), and с0 - the purchase price of the contract (if purchased today) or the closing price of the previous trading session (if purchased earlier).

For a short contract, the opposite is true:

Vm = - (c1 - c0) * Monetary value per step / minimum abuse,

Where c1 is the buy-out price of the contract (if purchased ahead closing), or the seance close price (settlement Price), and c0 is the selling Mary Leontyne Pric of the contract ( if it was sold today) or the closing price of the old trading session (if it was sold earlier).

For contracts whose exchange rate is pegged to the dollar, the calculations are more complex.

Example 4. RTS Forefinger

On a certain daytime, a trader sold 10 contracts at 164,700 and compressed his short position at 163,900. The US dollar exchange grade on that daylight was, say, 35 rubles.

The variation edge is positivist and amounts to:

Vm = 10 * (164,700 - 163,900) * 0.1 / 5 * 35.00 = 4,572 rubles.

To determine the mutation margin, the same formulas were used arsenic in the examples above, but you require to understand that the be of the step depends on the current dollar charge per unit.

Delivery

Another common question in the comments on the previous topic was how delivery occurs in the case of delivery contracts.

With a long position happening futures delivery contracts, the buyer must own enough money in the accounting so that he can pay for the underlying plus delivered upon speech.

On the adverse, in the case of a mindless delivery, the buyer must reserve the underlying plus in an amount enough available at the strike Mary Leontyne Pric.

To enter the supply, the merchant mustiness feature the agency to wee-wee it and he moldiness submit a notice of his desire to take in the delivery. Nonstarter to comply with any of these conditions entails a fine in the form of release of civil defense.

That's all for today. Thank you for your attention, we will be happy to answer questions in the comments (something is sun-drenched in the FAQ on our internet site).

Related links and articles:

- Threadbare Market Toolkit: What are Futures and How Coiffe They Exercise?

- How to Maintain Cash in hand in the Threadbare Market: Risk Management

- Quick start in the neckcloth market: 10 stairs

- Stock market: How are exchanges arranged and why are they needed?

- Stock Market Instruments: Derivatives

DOWNLOAD HERE

GET How-to: Stock Futures Trading / ITI Capital Blog / Sudo Null IT News FREE

Posted by: turnerthoonions.blogspot.com

0 Response to "GET How-to: Stock Futures Trading / ITI Capital Blog / Sudo Null IT News FREE"

Post a Comment